TUESDAY 24-02-2026

at.tantia@gmail.com

Shri Pitrani Ji

The Contact Chair for Queries....

SEBI REGISTRATION ( RA ) NAME :- ANAND KUMAR TANTIA

BSE ENLISTED NUMBER --5200

SEBI REGISTRATION NUMBER :- INH100003381

WEBSITE NAME :-www.kirtiscripscan.net

Mobile App :- KirtiscripScan

Email:-at.tantia@gmail.com

LOGO:-

MOBILE NUMBER:-91-9549901515

WHATSAPP NUMBER:-7568046006

ADDRESS :-Anand Kumar Tantia,Tantia House Near Subhash Chowk,Khyamkhani Mohalla

Hanumangarh Town (Raj.335513)

Disclaimer that:- 'Registration granted by SEBI, and certifactes from NISM is no way guarantee performance

of the intermediary or provide any assurance of returns to investor'

Standard Warning :- ' Investment in securities market are subject to market risks.

Read all the related documents carefully before investing. '

“Disclosure with respect to compliance with Annual compliance audit requirement under Regulation 25(3) of SEBI (Research Analyst) Regulations, 2014 for last financial years are as under:

S.No. |

Financial Year |

Compliance Audit Status |

Remarks, If Any |

1 |

FY 2023-24 |

Conducted |

No |

2 |

FY 2024-25 |

Conducted |

No |

____________________

India’s push towards renewable energy sources and electrification projects

has fueled the demand for electric insulators.

Electric insulators are mainly used in applications where the prevention of

the flow of electric charges is required.

These materials work as effective non-conductors since they lack

the movable electric charges required to propagate electric current.

Electrical insulators are used mainly

as parts of electrical equipment.

With the rapid pace of infrastructure development and rural electrification

initiatives in India

there is a substantial market opportunity

for electric insulators.

India electric Insulator market is segmented into

Cables and Transmission Lines, Switchgears

Transformers, Busbars, and Others.

Among all these segments, Cables and Transmission Lines held

the highest market share in 2023.

___________________

![]()

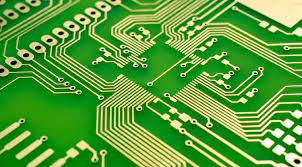

Chips do not function by themselves.

They need to be connected and surrounded

by electronic components, sensors, and a power source.

Printed Circuit Boards accomplish this critical task.

From iPhones to F16 fighters, from data centers

to dishwashers, all are based on Printed Circuit Boards (PCBs).

If chips are a product’s brain, the PCB is the skeleton

So success of semiconducter industry depend on PCB inds.

PCBs are the backbone of electronic products.

They are used to support and connect electronic components

in all electronic applications.

The PCB manufacturing process has basic steps such

as etching, laminating, drilling, electroplating, lithographing,

and screen printing.

________________________

ALERT:--

(ALL ABOVE UPDATE FOR INFORMATION ONLY )

Note: -- This does not constitute investment advice return mentioned here in

are in no way a guarantee or promise of future return.

Stock market investments are subject to market risks.

Standard Warning :- ' Investment in securities market are subject to market risks.

Read all the related documents carefully before investing. '

_________________________

FOR DOWNLOAD KIRTI APP

(CLICK HERE)

____________________________

Note: -- This does not constitute investment advice return mentioned herein are in no way a guarantee or promise of future return. Stock market investments are subject to market risks.

Standard Warning :- ' Investment in securities market are subject to market risks.

Read all the related documents carefully before investing. '

MUST READ---Disclosure Disclaimer(Click Here)

___________________________________________________________________________________________________